FMP

The Significance of Terminal Value in DCF Valuation

Dec 19, 2023

Introduction:

In Discounted Cash Flow (DCF) valuation, the terminal value estimation holds significant importance, representing a substantial portion of the total enterprise value. This article delves into understanding the concept of terminal value, its calculation methods, and its pivotal role in determining the intrinsic value of an investment.

Terminal Value in DCF Analysis:

1. Definition: Terminal value denotes the value of a project or an asset at a specific future point, beyond the explicit forecast period in a DCF analysis.

2. Importance: It captures the value of a business beyond the explicit forecast period, which often contributes significantly to the overall enterprise valuation.

3. Calculation Methods: Commonly, two approaches are employed to calculate terminal value: the perpetuity growth method (Gordon Growth Model) and the exit multiple method.

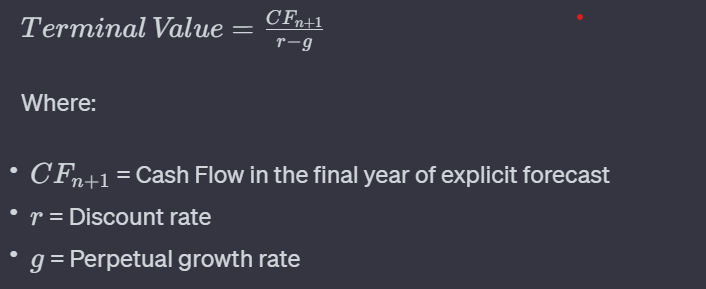

Gordon Growth Model:

The Gordon Growth Model assumes a constant growth rate indefinitely into the future, expressed as:

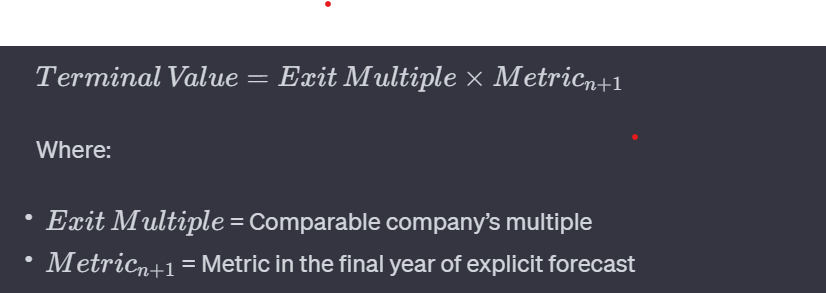

Exit Multiple Method:

The Exit Multiple Method estimates terminal value by applying a comparable company's multiple to a financial metric (e.g., EBITDA, Earnings) of the subject company:

Importance of Terminal Value in Investment Valuation:

1. Extended Forecast Horizon: Terminal value extends the valuation horizon beyond the explicit forecast period, capturing the business's perpetual cash flow-generating potential.

2. Significance in Valuation: Often, the terminal value accounts for a substantial proportion of the total enterprise value in DCF analysis, significantly influencing the final valuation.

3. Sensitivity Analysis: Given its impact on valuation, terminal value estimates are subject to sensitivity analysis to evaluate the robustness of valuation under varying scenarios.

Conclusion:

The terminal value estimation in DCF analysis is a critical component influencing the overall intrinsic value of an investment. Accurate calculation and understanding of this value are essential for investors and financial analysts, as it determines a significant portion of the projected future cash flows and plays a pivotal role in investment decision-making.

MicroStrategy Incorporated (NASDAQ:MSTR) Earnings Preview and Bitcoin Investment Strategy

MicroStrategy Incorporated (NASDAQ:MSTR) is a prominent business intelligence company known for its software solutions a...

WACC vs ROIC: Evaluating Capital Efficiency and Value Creation

Introduction In corporate finance, assessing how effectively a company utilizes its capital is crucial. Two key metri...

BofA Sees AI Capex Boom in 2025, Backs Nvidia and Broadcom

Bank of America analysts reiterated a bullish outlook on data center and artificial intelligence capital expenditures fo...