FMP

How to Analyze Company Financial Statements Using FMP's Financial Statement Growth API Endpoint

Jul 14, 2025

When you're looking to invest in a stock, it's important to understand how the company is growing over time. One of the easiest ways to do this is by checking the company's financial growth metrics using the Financial Statement Growth API Endpoint

This guide will explain step-by-step how to use this API, what the data means, and how to analyze Apple Inc. (AAPL) as a real-life example.

Step 1: Get Your FMP API Key

To access financial data, first get your custom API key.

Step 2: Use the Financial Growth Endpoint

Once you have your key, paste this link into your browser (replace `custom_api_key` with your real key):

https://financialmodelingprep.com/stable/financial-growth?symbol=AAPL&apikey=custom_api_key

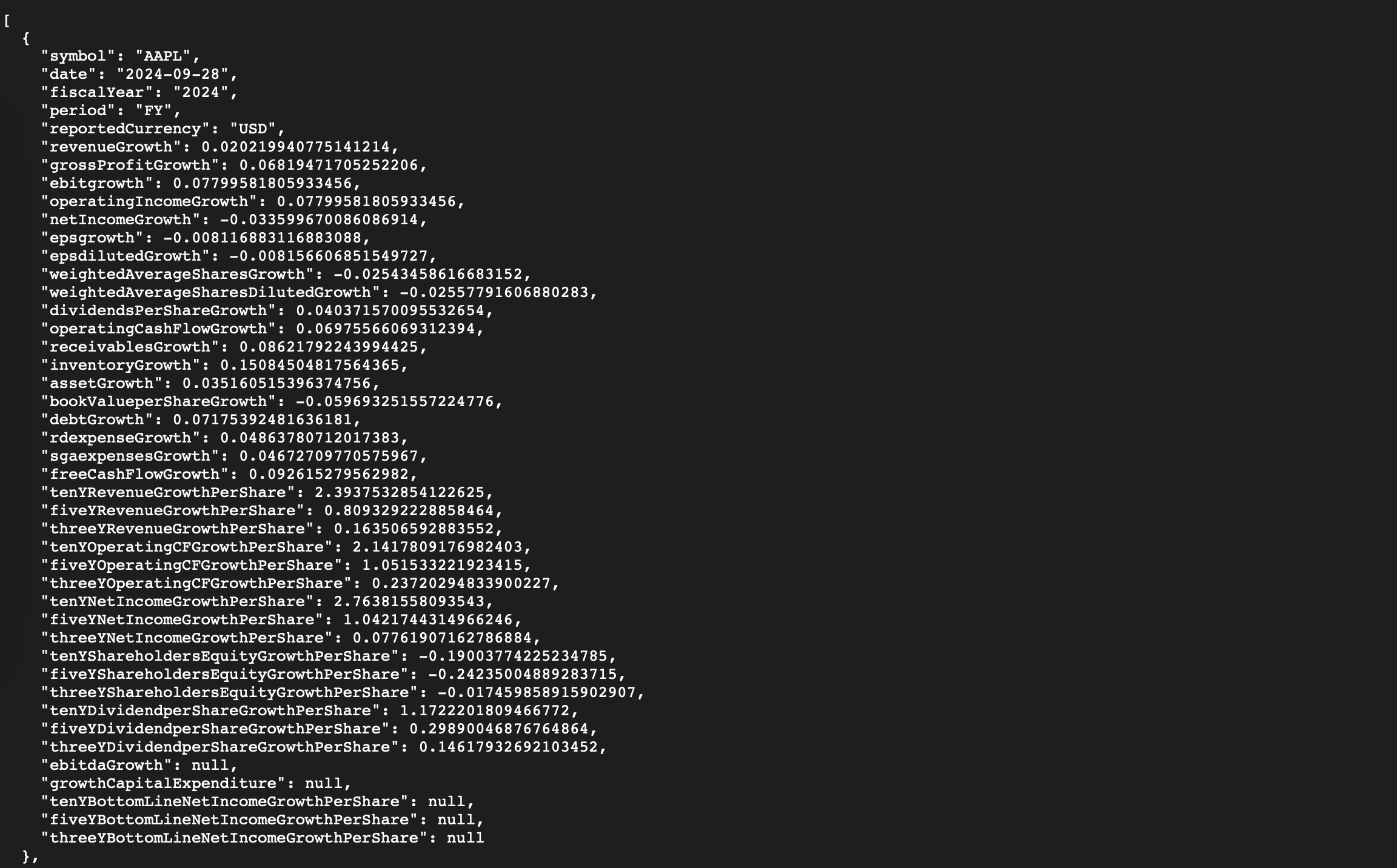

You'll get back a list of data in JSON format, which looks like a bunch of numbers and words. Don't panic, we'll break down what it means.

Step 3: Understand the Most Important Growth Metrics

This API gives you yearly growth rates for key financial numbers. Here are the most useful ones:

revenueGrowth - Is the company making more money?

netIncomeGrowth - Are profits rising?

epsgrowth - Is earnings per share increasing?

freeCashFlowGrowth - Is the company generating extra cash?

bookValueperShareGrowth - Is its net worth growing?

debtGrowth - Is the company taking on more debt?

rdexpenseGrowth - Is the company investing in innovation?

inventoryGrowth - Are inventories managed well?

Example: Apple Inc. (AAPL) Financial Growth Analysis

Let's take a quick look at the past 2 years of Apple's growth data using this API.

2024 vs 2023

Revenue growth: +2.02% (small increase)

Net income growth: -3.36% (profit dropped slightly)

EPS growth: -0.81% (earnings per share fell)

Free cash flow growth: +9.26% (great!)

Inventory growth: +15% (could mean slower sales or preparation for new launches)

R&D expense growth: +4.86% (steady investment in innovation)

Apple saw modest sales growth but a drop in profits and earnings per share. However, its free cash flow increased significantly, which is a strong positive sign of financial strength. The rise in R&D spending shows Apple is still investing in the future. The increase in inventory may suggest buildup before a product launch or slower-than-expected sales.

---

2023 vs 2022

Revenue growth: -2.8% (sales declined)

Net income growth: -2.8% (profits also declined)

EPS growth: +0.16% (flat)

Free cash flow growth: -10.6% (cash generation weakened)

Inventory growth: +28% (inventory buildup could be risky)

Debt growth: -16.1% (Apple paid off debt — good!)

This was a weaker year for Apple. Sales and profits fell, and the company generated less cash than before. However, it managed to slightly grow its earnings per share and reduced its debt significantly, which shows financial discipline. The 28% spike in inventory is a concern and could point to slower sales or overproduction.

What Can Traders Learn From This?

1. Trends Matter - Look at 2-3 year patterns. Is growth steady, improving, or declining?

2. Watch Cash Flow - Free cash flow growth often signals strong financial health.

3. Avoid Red Flags - Large drops in net income or big jumps in inventory may signal trouble.

4. Look Beyond Profit - If R&D is growing, it could mean new products are on the way.

Financial Statement Growth API Endpoint from FMP is a powerful and beginner-friendly way to understand how a company is performing. Start by analyzing your favorite stocks and let the numbers guide your next move!

MicroStrategy Incorporated (NASDAQ:MSTR) Earnings Preview and Bitcoin Investment Strategy

MicroStrategy Incorporated (NASDAQ:MSTR) is a prominent business intelligence company known for its software solutions a...

WACC vs ROIC: Evaluating Capital Efficiency and Value Creation

Introduction In corporate finance, assessing how effectively a company utilizes its capital is crucial. Two key metri...

BofA Sees AI Capex Boom in 2025, Backs Nvidia and Broadcom

Bank of America analysts reiterated a bullish outlook on data center and artificial intelligence capital expenditures fo...